- Phone: 1-780-655-8936

- Email: info@finesse-tech.ca

Services We Offer

- Hyperion Financial Management

- Hyperion Planning

- Hyperion Essbase

- Hyperion Strategic Finance

- Financial Data Quality Management

- Hyperion Profitability & Cost Management

- Data Relationship Management

- Disclosure Management

With Oracle Hyperion Financial Management—part of Oracle’s Hyperion Financial Close Suite —organizations can improve their consolidation and reporting process and reduce internal control risks. Financial managers move from the role of scorekeeper to one of business partner—delivering financial and non-financial analysis that supports strategic and operational management decisions. With purpose-built features, Oracle Hyperion Financial Management is the cornerstone of sustainable compliance frameworks and helps businesses comply with the many different and stringent regulatory reporting regulations.

Oracle Hyperion Financial Management provides enterprise-class functionality and depth in consolidation and reporting. In addition, the module is used and maintained by finance professionals—unlike data warehouse and other enterprise reporting solutions that usually require IT customization and support.

Oracle Hyperion Financial Management can reduce consolidation and reporting cycles by days or weeks. By minimizing the need to enter, check, and double-check actual results, the finance team can spend more time on forward-looking activities.

Key features:

- Global consolidation features

- Scalable web architecture

- Unlimited dimensionality

- Complete audit trails

- Powerful reporting and analysis tools

- Robust data integration

- Mobile device reviews and approvals

Key Benefits:

- Reduce consolidation, close, and reporting cycles by days or weeks and deliver timely results internally and externally

- Serves as a single version of truth for financial reports to meet managerial as well as regulatory reporting requirements

- Reduce compliance costs through automated and preventative controls by supporting the stipulations for SOX and other regulatory requirements

- Maintain a regulatory filing to general ledger audit trail, providing confidence in the financial results

- Conduct in-depth analysis of key performance and operational metrics easily

- Discover new sources of profitability and cash flow by company, product, brand, and customer segment

- Realize new benefits quickly with packaged regulatory reporting functionality

- Add the capabilities of a comprehensive suite of enterprise performance management applications as needs and budgets dictate

Oracle Planning & Budgeting Solution

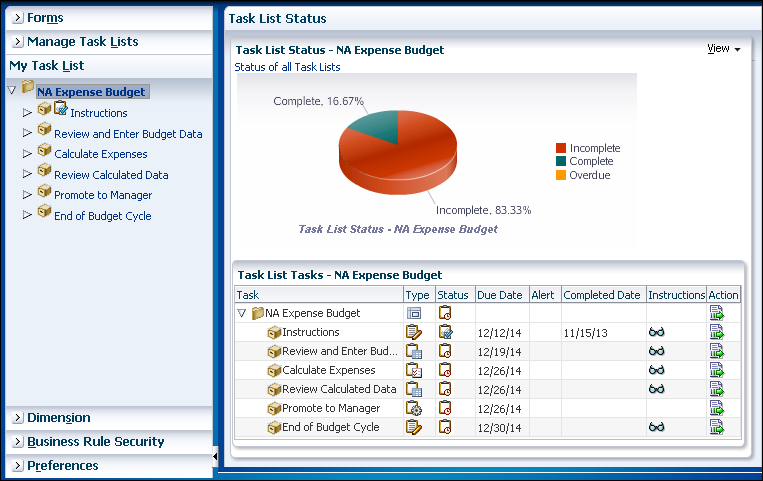

The Oracle Hyperion Enterprise Financial Planning Suite provides an integrated solution for strategic, financial and operational planning processes. Leveraging the power of Oracle Essbase, our market- leading OLAP server, Oracle Hyperion Planning applications provide many pre-built features, as well as a common web interface, workflow and process management to help streamline the planning, budgeting and forecasting process.

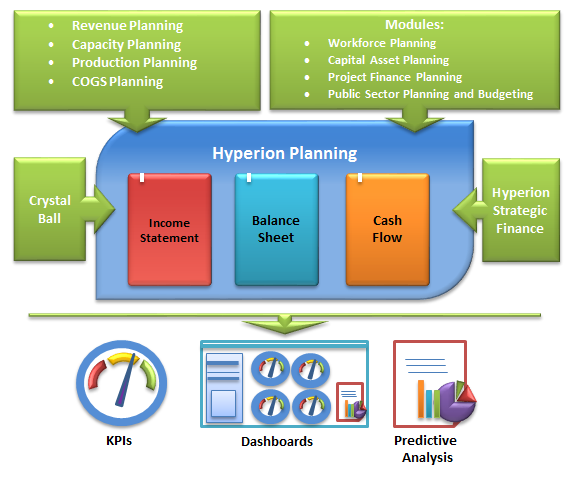

The Oracle Hyperion Enterprise Financial Planning Suite (figure 1) includes core financial budgeting and planning functionality as well as purpose-built modules for strategic planning, workforce planning, capital expense planning, project financial planning and data integration. The modules can be easily configured to address specific planning requirements and integrated with operational planning applications like Oracle Value Chain Planning, as well as third party sales and operations planning systems.

Figure 1 Oracle Hyperion Enterprise Financial Planning Suite and additional options.

Enterprise Planning Suite

The Oracle Hyperion Enterprise Financial Planning Suite includes the following modules:

Oracle Hyperion Planning – a centralized, Microsoft Office, Mobile and Web-based planning, budgeting, and forecasting solution that integrates financial and operational planning processes. It supports best practices such as rolling forecasts and driver-based planning to enable dynamic operational planning and the ability to evaluate the impact on financials.

Oracle Hyperion Workforce Planning – a purpose-built module that enables quick and efficient planning for head count, salary, and compensation across the enterprise.

Oracle Hyperion Capital Asset Planning – a purpose-built module that allows the planning of existing and new capital assets, maintenance, transfers, and depreciation while analyzing their impact on income, balance sheet, and cash flow.

Oracle Hyperion Project Financial Planning – a purpose-built module designed to support financial planning and forecasting for contract, capital and indirect projects.

Oracle Hyperion Strategic Finance – a financial modeling application that lets executives identify and understand the full financial impact of alternative corporate strategies.

Oracle Crystal Ball – for predictive modeling and scenario analysis.

KEY FEATURES:

- Hybrid data model facilitates planning, analysis and commentary

- Flexible workflow capabilities

- Reliability with predictive planning capabilities

- Seamless Microsoft Office integration

- Collaboration and alignment with easy to use mobile friendly web interface

- Built in reporting and dashboards

- Proven and scalable architecture

- Robust integration with ERP sources with drill back

- Enterprise grade deployment and backups

- Agility with full mobile planning and workflow capabilities

KEY BENEFITS:

- Reduce budgeting and planning cycles by weeks or months

- Improve accuracy of plans and forecasts

- Optimize resource allocations and improve performance

- Focus Finance resources on value added analysis

- Deploy quickly with pre-built functionality

- Leverage existing IT investments

- Appeal to a wider user community through an intuitive Web user interface

- Provide familiar user interface for users with full Microsoft Office integration

- Reduce planning cycles with anywhere, anytime mobile

- Eliminate time lag between when plans are updated and reports are refreshed

- Reduce cost of ownership through superior application deployment, management tools and packaged data integration

- Lay the foundation for making the transition to Enterprise Business Planning

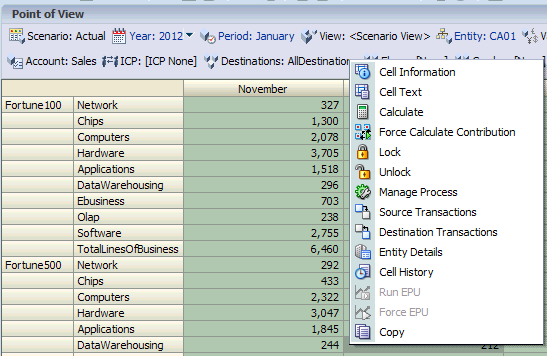

Oracle Essbase is the industry-leading multi-dimensional online analytical processing (OLAP) server, providing a rich environment for effectively developing custom analytic and enterprise performance management applications. By leveraging its self-managed, rapid application development capabilities, business users can quickly model complex business scenarios. For example, line-of-business personnel can simply and rapidly develop and manage analytic applications that can forecast likely business performance levels and deliver “what-if” analyses for varying conditions. Oracle Essbase supports extremely fast query response times for vast numbers of users, large data sets, and complex business models.

Oracle Essbase brings advanced analytics to the business user to enable greater understanding of the business, alignment of resources and improved business results. With the advantage of consistent, subsecond response times, users can interact with the data at the speed-of-thought without support from technical experts. This ability to “converse” with the data — understanding that an answer to one question leads to another — enables business users to better identify and analyze the metrics and relationships that influence performance, and to make better, more informed decisions. Users can share their saved reports, and modify their appearance, or create powerful additional queries as new questions arise.

KEY FEATURES AND BENEFITS

- Move beyond silos of business intelligence and disconnected spreadsheets

- Realtime analysis of key customer data, finances and spending, and product profitability

- Cost-saving links to existing systems

- Speed-of-thought analysis for thousands of concurrent users

- Fast and easy development, deployment, and maintenance

- Robust security system

- Uses innovative, visual, easy to understand interfaces

- Enables rapid discovery of trends and highlights these trends in large data sets

- Leverages investments in legacy systems

Finesse Essbase Service offerings:

- New Essbase implementations.

- Application reviews.

- Redesign of existing applications, complex business calculation scripts and member formulae.

- Migrations & upgrades.

- Essbase partitioning.

- Essbase database optimisation and performance tuning.

- Essbase data & system integrations.

- Administration of Essbase databases.

- Essbase database backup.

- Automation for metadata and outline updates, data load, calculation logics and application maintenance.

- Client specific training & documentation.

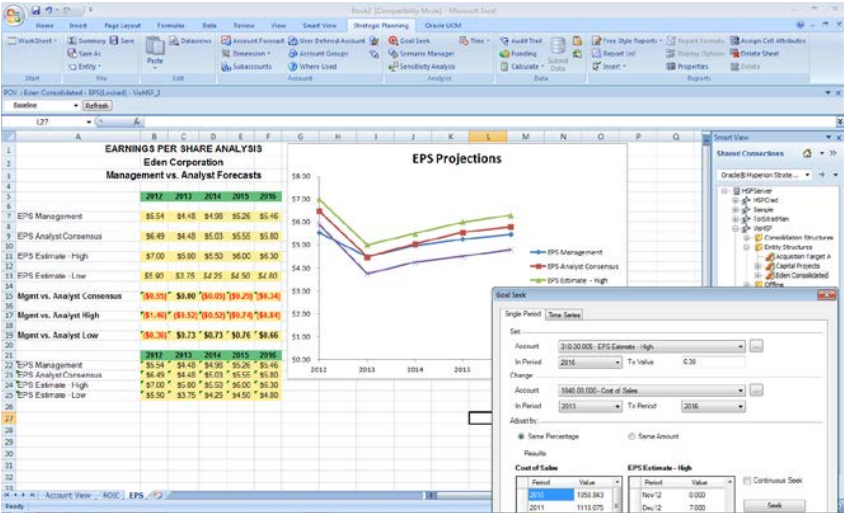

Oracle Hyperion Strategic Finance (HSF) provides sensitivity and what-if analysis capabilities, allowing organizations to gain deeper, sounder strategic insights as users create scenarios to model the business. Integration with Oracle’s Hyperion Performance Management Applications and Oracle Essbase enables users to analyze and understand the potential disconnects between targets, strategic and operational plans and actual results.

Oracle Hyperion Strategic Finance integrates strategic planning into the enterprise planning process. It allows users to quickly develop financial models, perform on the fly what-if impact analysis based on dynamic decision variables and arrive at targets that can then be used within other enterprise performance management processes. Oracle HSF enables organizations to do closed loop, strategy oriented performance management and is an integral part of Oracle’s EPM suite.

Key features:

- What-if analysis toolkit to support unlimited scenarios

- Analyze trail feature to visualize model logic

- Funding options to optimize capital structure

- Freestyle reporting for professional quality reports and graphs

- Extended analytics for integrated enterprise reporting & analysis

- Debt scheduler to model cash flow implications of debt

- Consolidation & deal period functionality to simulate roll ups, mergers and acquisitions

- Tax and valuation options to calculate tax effects and enterprise value

- Uses the same Microsoft Office user interface as other Oracle Hyperion products

Key Benefits:

- Integrate financial modeling for strategic planning, treasury, and corporate development

- Model with integrity and transparency to minimize risk and create efficiencies

- Minimize model building efforts with packaged financial modeling tools

- Deploy and implement quickly with minimal IT support

Oracle Hyperion Financial Data Quality Management (FDQM/FDM)eliminates the data integrity risks associated with collecting, mapping, verifying, and moving critical financial data. With it, you can build standardized, repeatable processes and avoid the typical inefficiencies of collecting financial data. These transparent processes give you greater assurance of clean data and accurate results. Finance organizations need to enhance the quality of internal controls and reporting processes. To meet these goals, you need a source-to-report view of financial data. Oracle FDM allows business analysts to develop standardized financial data management processes and validate data from any source system—all while reducing costs and complexity.

Oracle FDQM/FDM is a packaged solution for finance users that helps develop standardized financial data management processes for collection, mapping, verification and movement of financial data. The product’s web-based guided workflow user interface eases integration and validation of financial data from any of the source systems.

With the new version release of Oracle Financial Data Quality Management, Enterprise Edition (FDMEE) the movement of data & metadata has been simplified for both technical and finance users. We provide upgarde/migration services for FDQM classic to the new FDMEE version.

KEY FEATURES AND BENEFITS

- Achieve timeliness of data with a Web-guided workflow process

- Automated data mapping and loading

- Increases your confidence in the numbers

- Lower the cost of compliance

- Simplify financial data collection and transformation

- Deliver process transparency through audit trails

- Improve the productivity of finance staff

- Support multi-GAAP reporting

Finesse Data Quality Management Service offerings:

- Integrating with HFM, Planning, Essbase and other target systems.

- Integrating with source legacy GL systems and data warehouses.

- Mapping table triangulation and validation.

- ETL automation.

- Multi-period processing.

- Data integrity and protection checks.

- Administration of FDQM.

- Automation scripts and batch processing.

- Client specific training & documentation.

Oracle Hyperion Profitability & Cost Management (HPCM) is an analytical performance management application that provides actionable insights into cost and profitability. HPCM is used to model costs and revenues, perform complex allocations, calculate business segment profitability and determine overall profitability.

HPCM improves organisational performance by discovering drivers of cost and profitability, identify value add products and services, establish benchmarks and enable process improvements.

Finesse consultants are certified professionals in costing and have a deep technical knowledge in HPCM.

Finesse offerings for HPCM are:

- New HPCM implementations – standard and detailed models.

- Facilitate designing of profitability solution.

- Reviewing drivers and their effect analysis.

- Waterfall allocations.

- Activity Based Costing.

- Customer, Business Segment and Product Profitability.

- Integrating with HFM and Planning.

- Integrating with source legacy GL systems and data warehouses.

- Conversions from excel based profitability and costing systems to HPCM.

- Administration of HPCM.

- Client specific training & documentation.

Oracle Data Relationship Management (DRM) is an enterprise change management solution for building and retaining consistency within master data assets despite endless changes necessary to support underlying transactional and analytical systems. Master Data Management (MDM) strategy is key to an organization’s data governance. DRM offers a foundation for establishing the disciplines, processes, and governance required to administer an Enterprise MDM Strategy.

Oracle Data Relationship Management unifies cross-functional perspectives to a master record while enabling business users to contribute to the process of managing complex master data by constructing alternate departmental views of the data that are consistent and accurate. The product also enables IT administrators to ensure data integrity and security by keeping data management processes consistent with company policies. IT can codify business rules and configure validations to ensure that users do not compromise the integrity of enterprise master data as they reconcile their departmental perspectives within a common platform.

Finesse consultants have successfully implemented DRM for large organizations and streamlined the data management process across the company.

KEY BENEFITS

- Save time and resources spent reconciling reports and measures across business units

- Reduce or eliminate errors in data flow between operational and analytical systems

- Maintain data integrity across divisions and systems

- Empower users to easily make data changes based on their role or responsibility

- Minimize manual IT data maintenance tasks

- Perform reliable what-if scenarios and impact analyses

- Ensure consistent corporate definitions and metrics

- Achieve Sarbanes-Oxley (SOX) compliance

Finesse offerings for DRM are:

- New DRM implementations.

- Redesigning existing applications.

- Integrating with GL and EPM systems.

- Administration of DRM.

- Client specific training & documentation.

Oracle Hyperion Disclosure Management allows users to develop their regulatory filings in a unified, collaborative evironment. SEC filers, for example, may generate both XBRL and EDGAR HTML filing outputs from the same source, ensuring 100% validation of both filing formats. It also emphasizes reuse and efficiency through its easy-to-use rollover process, providing XBRL tag migration and variable-driven smart text. Users may manage their metadata directly from Oracle Hyperion Enterprise Performance Management (EPM) data sources, Microsoft Office documents, and other third party sources. The common foundation and tight integration with other EPM applications provides a single point of maintenance and centralized control over the entire financial close process. This unified framework gives users the assurance that all reporting requirements can be met accurately and efficiently in a streamlined integrated process.

Oracle Hyperion Disclosure Management is a complete regulatory filing creation and management solution. With Oracle Hyperion Disclosure Management customers will come to view XBRL as “just another reporting format” like PDF, HTML, etc. Oracle Hyperion Disclosure Management is part of Oracle’s market-leading suite of financial close and reporting solutions that addresses all stages of the extended financial close from sub-ledger and general ledger closings, to the collection and consolidation of financial results, financial and management reporting, and the creating and submission of regulatory filings.

Key features:

- Regulatory publishing in XBRL, iXBRL, PDF and SEC EDGAR HTML formats

- Variables for managing common text, dates, numbers and directional words

- Cross-footing for data accuracy

- Table of Contents automation

- SEC, HMRC, IFRS and XBRL formula validation support

- Direct mapping to Oracle Hyperion data sources

- XBRL tag override and suppression capabilities

- Rollover report management

- XBRL taxonomy management and extension development

- Oracle WebCenter Content Management for document routing, approval, security and revision control

Key benefits:

- Easy regulatory reporting with data quality assurance

- Deep integration with Oracle Hyperion Financial Management, Oracle Hyperion Planning, and Oracle Essbase

- Best in class document management